Transparency is at the heart of everything we do at Bondora. We know how important it is for you to have easy access to key statistics on borrowing, investing, and loan performance.

That’s why we’ve revamped our Statistics page so it is easier to understand, more accessible, and consistently updated with the data that matters most to you.

Built with your feedback

Our customers and partners have shared that having clear, regularly updated insights is crucial to building trust. We always take your feedback to heart. Our new Statistics page, which launched on 6 March 2025, is another step in delivering the information you need when you need it.

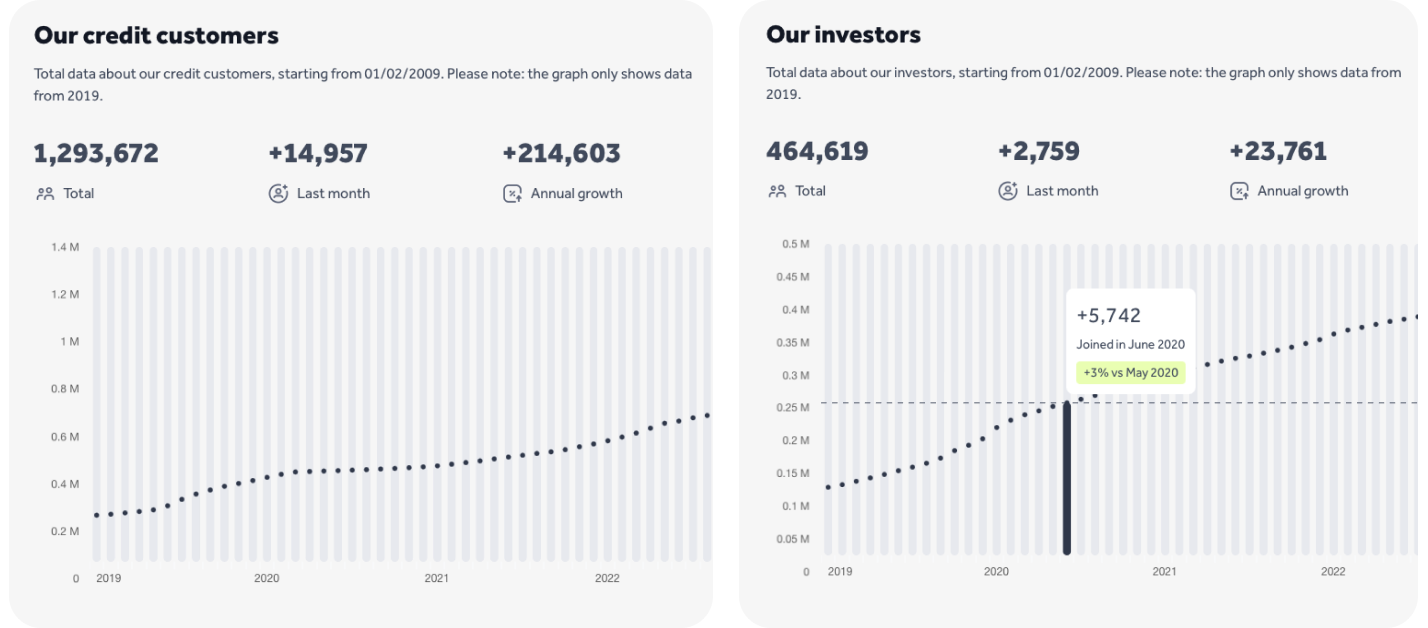

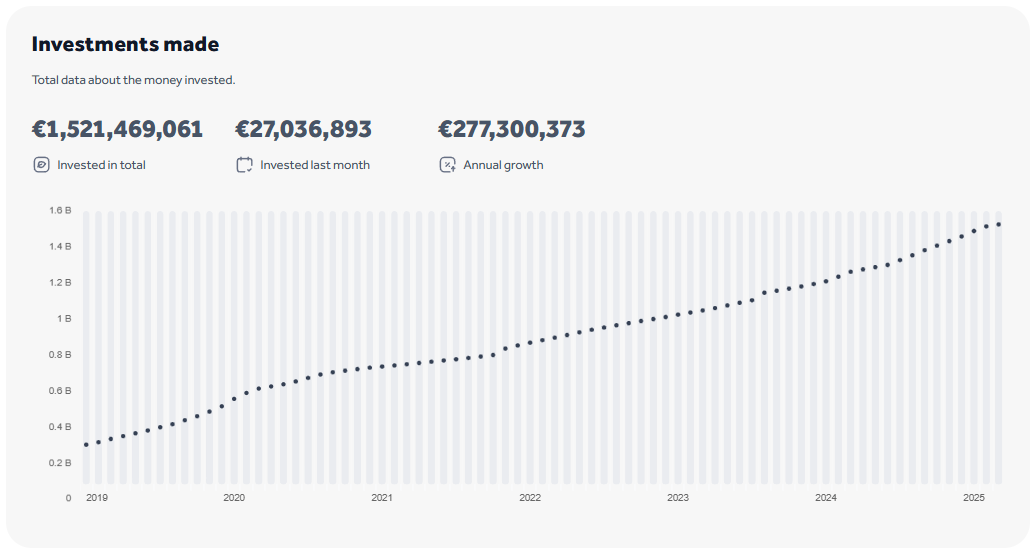

From investor numbers to loan portfolio insights, the revamped Statistics page gives you a clearer view of Bondora’s key data. Whether you’re tracking borrower activity, total investments, or returns, you can now access this information in a format that’s easier to navigate and updated regularly.

Take a look at some of the key data points available on the refreshed page:

While this first version includes essential insights, we’re committed to expanding it further. Some loan portfolio performance data isn’t automated yet, but we’ll be rolling it out step by step. In the meantime, you can find this data below and expect regular updates to keep you informed.

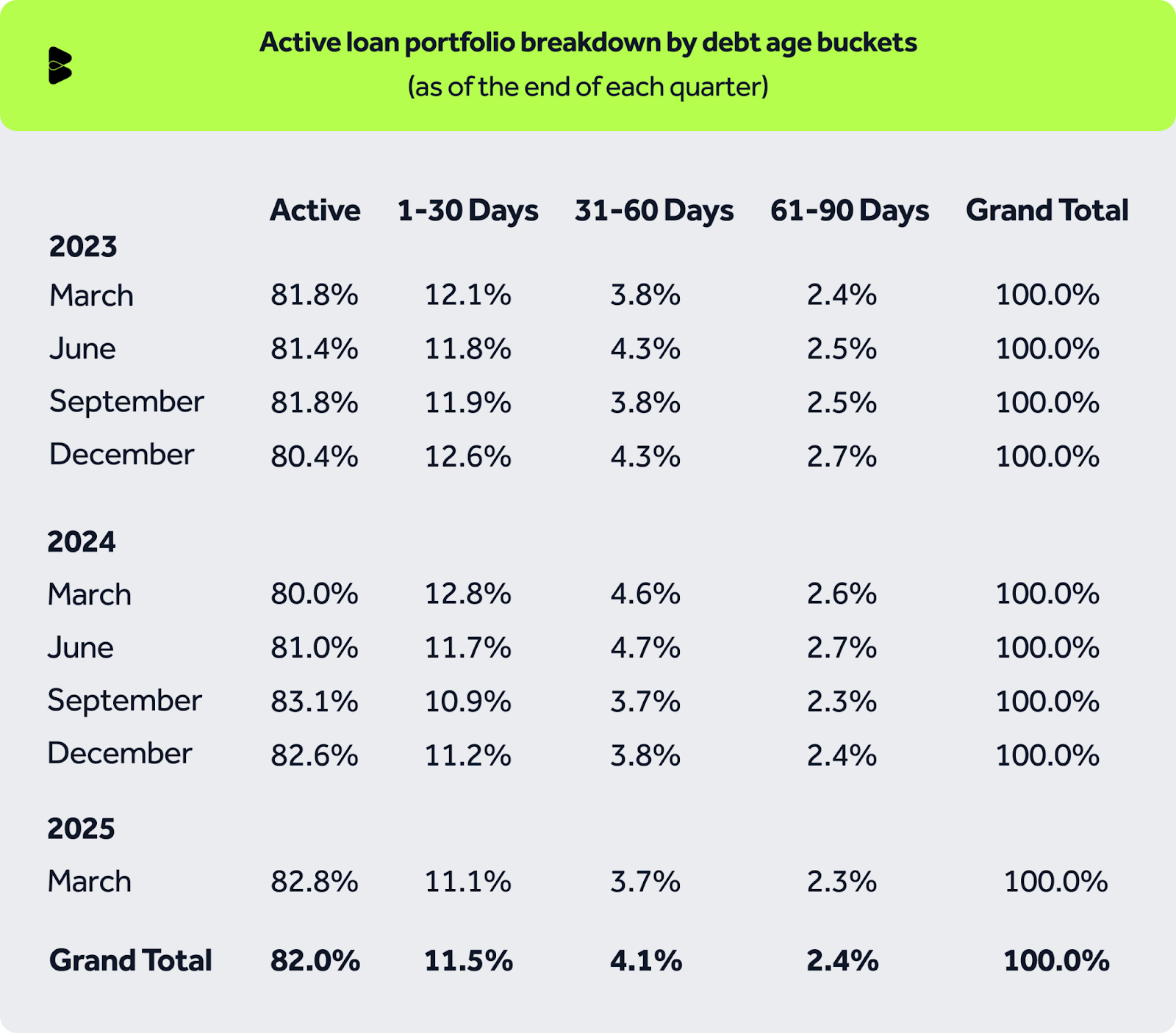

Loan portfolio details

Our active loan portfolio has remained consistently stable, with over 80% of loans remaining active across all periods. Delinquency levels across different aging buckets have shown only minor variations, indicating strong portfolio health.

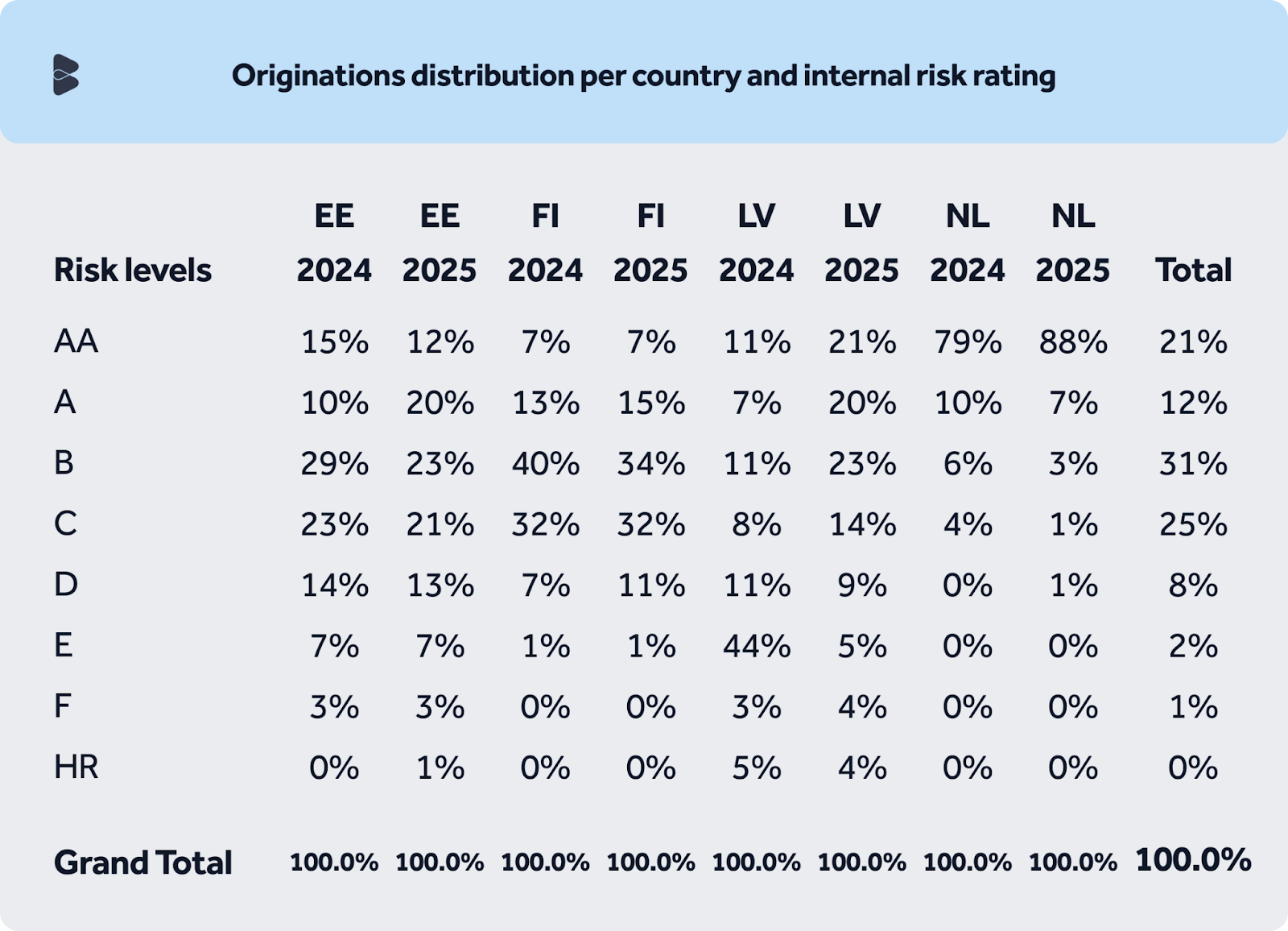

The majority of our originations fall within low-risk levels. We continue to take a prudent approach to risk management by increasing the proportion of loans in the AA-C risk categories across all markets.

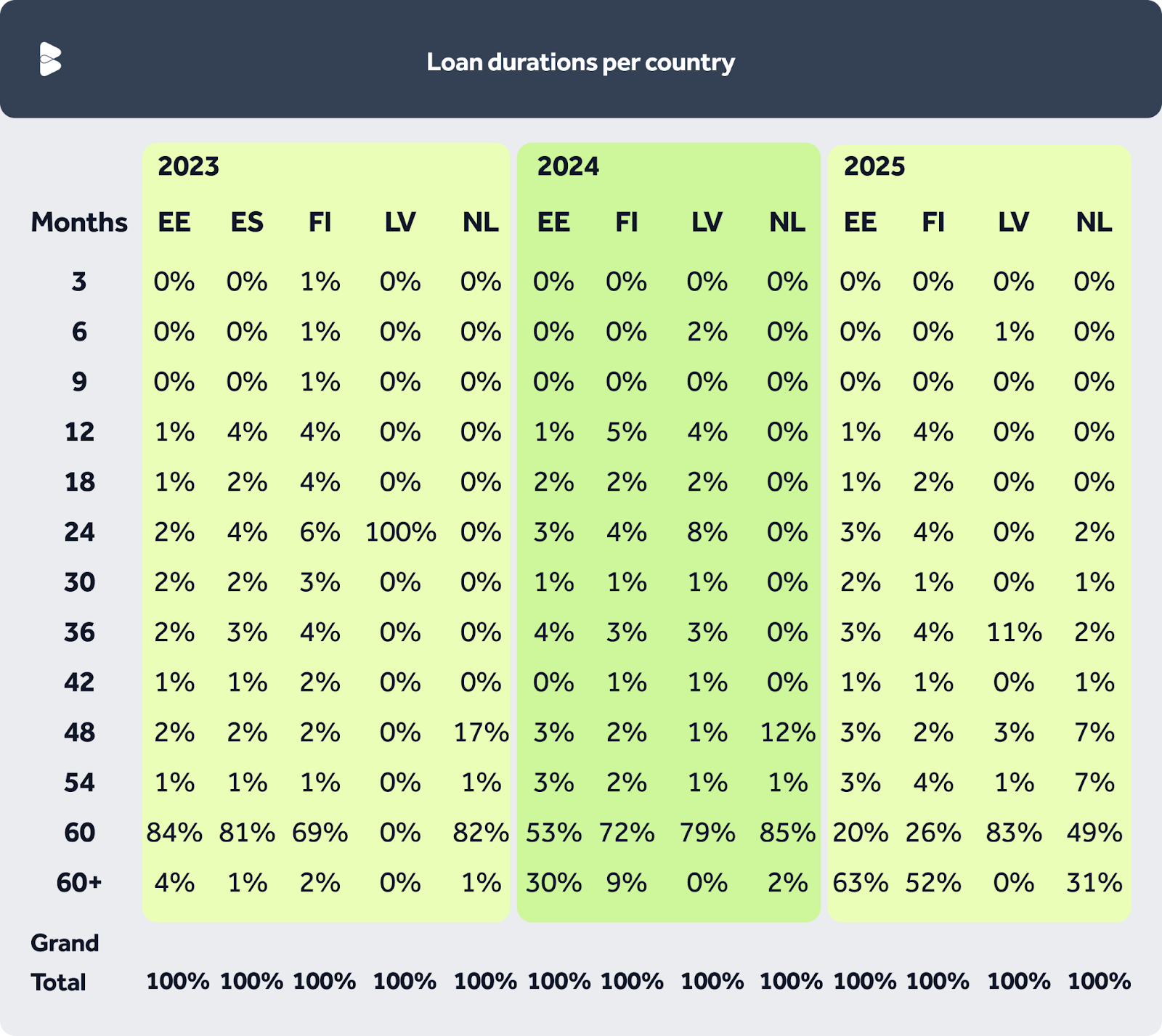

Our loan customers generally prefer longer loan durations, as they result in more manageable monthly payments. Offering extended terms allows for more loan issuance at lower risk levels while maintaining a higher percentage of on-time repayments.

We will continue to provide you with detailed insights in future updates as we enhance and expand the data we share.

Help shape the next update

This page was built for you—so tell us what you’d like to see next! At the bottom of the Statistics page, you’ll find a survey where you can share your feedback and let us know what additional data would be most valuable to you! Your input will help us build future updates.

More financial insights coming soon

This blog post focused on our revamped lending and investment statistics, but there’s more data on the way. Our audited annual financial report will be published soon, giving you a broader look at Bondora’s financial performance in 2024. Stay tuned!

📊 Explore the revamped Statistics page and share your thoughts.