What a way to start the year! In January, our investors set a new record for the most money invested into Go & Grow. They added a whopping €31,944,532 to their accounts, raising the bar higher than ever at the start of 2025. This is the kind of enthusiasm that could help build future financial success.

Loans issued by Bondora AS, part of the Bondora Group, dropped by 7.2%. Despite the slight decline, they totaled a steady €25,633,747.

Ready to discover our other new records and our first stats for 2025? Let’s jump right in!

In January, 3,071 new investors signed up to reach their financial goals with us. Welcome to you all.

Remember to refer your friends: Until 28 February, you and your invited friend can each earn €25! To learn more about this lovely referral reward and find your unique code, head over to your Dashboard.

Our investors added a record-breaking €31,944,532 to Go & Grow in January, raising the bar higher than ever!

Were you one of the investors contributing to your financial future and setting a new all-time high investment record?

Start the year off strong and add to your Go & Grow today.

Adding to our record streak is the total returns investors earned. Our Go & Grow community earned €3,016,555 in returns in January.

Since we started collecting this data for Go & Grow in 2024, this is the first time returns have exceeded €3M per month.

Now, that’s a rewarding way to kick off 2025!

‘I forgot to include transfer details in my payment. What should I do?’

Although payment transfers can be almost instant, they can take up to 3 business days, depending on your bank and the date and time of the transfer.

If 3 business days have passed and your payment is not in your Go & Grow account yet, please get in touch with us and provide us with a payment confirmation document (e.g., a receipt from your online banking) that shows:

- your bank information (IBAN),

- your name, and a timestamp of the payment.

Our team can then investigate and help to sort out the delay.

If you have more questions or encounter any other issues, please contact our Customer Support team here. They will be happy to help you.

In January, Bondora AS, which belongs to Bondora Group, originated €25,633,747 in loans. Although this is a slight decline of 7.2% from December, it remains at a stable level.

In Finland, loan customers originated €15,894,207 worth of loans, a 9.4% decline from December.

The Netherlands was the picture of stability, remaining virtually unchanged with €4,639,544 issued in loans. (That’s a 0.02% increase for those who love the details).

Once again, the Estonian market decreased slightly by 6.8% to a total of €4,791,616 loan origination.

Latvia was also incredibly stable, issuing €298,080 in originations – a 0.9% decline.

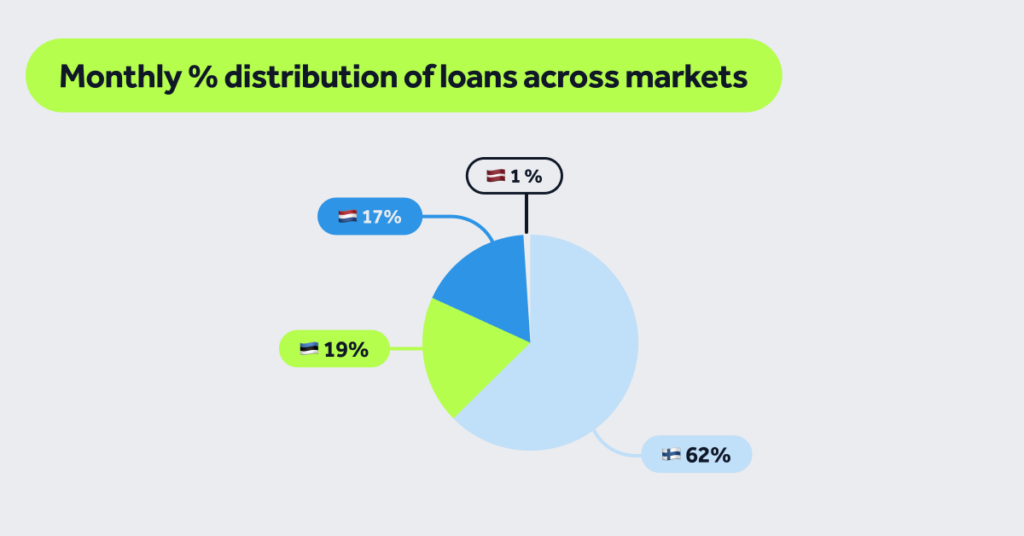

Here is a visual breakdown of our markets’ sizes in January 2025:

🇫🇮 Finland remains the market with the largest share of loan originations, this month totaling 62.0%.

🇪🇪 Estonia narrowly remains the 2nd largest market with 18.7% of all originations

🇳🇱 The Netherlands stays in 3rd with an 18.1% share, for now.

🇱🇻 Latvia remains in 4th place with a share of 1.2%

Have you not joined us on Instagram yet? Follow us for updates, fun and educational content, behind-the-scenes moments, and more!

Thanks for your interest in our first statistics for 2025. Stay tuned for more next month!